3DS v2: Increase security; increase conversion

Payments are changing. We’ve got you covered, but here’s what you need to know.

The EU’s Second Payment Services Directive (2015/2366 PSD2) entered into force in January 2018, aiming to ensure consumer protection across all payment types, promoting an even more open, competitive payments landscape. Acting as a payment service provider, Paypage prides itself on being confirmed PSD2 compliant since 29 May 2018.

One of the key requirements of PSD2 relates to Strong Customer Authentication (SCA) that will be required on all electronic transactions in the EU from 1st of January 2021, and in UK from the 14th of September 2021. SCA will require your customers to authenticate themselves with at least TWO out of the following three methods:

- Something they know (PIN, password, …)

- Something they possess (card reader, mobile. …)

- Something they are (voice recognition, fingerprint, …)

A simple transition to greater security

Anyone shopping online in the last decade will likely have experienced 3D Secure, which was designed to add a layer of security and move liability from merchants and on to banks. However, the redirect pages confused customers, causing them to abandon transactions.

A new version, 3D Secure v2 is now here to make authentication more convenient, helping you meet the required SCA standards by using data in a smarter way.

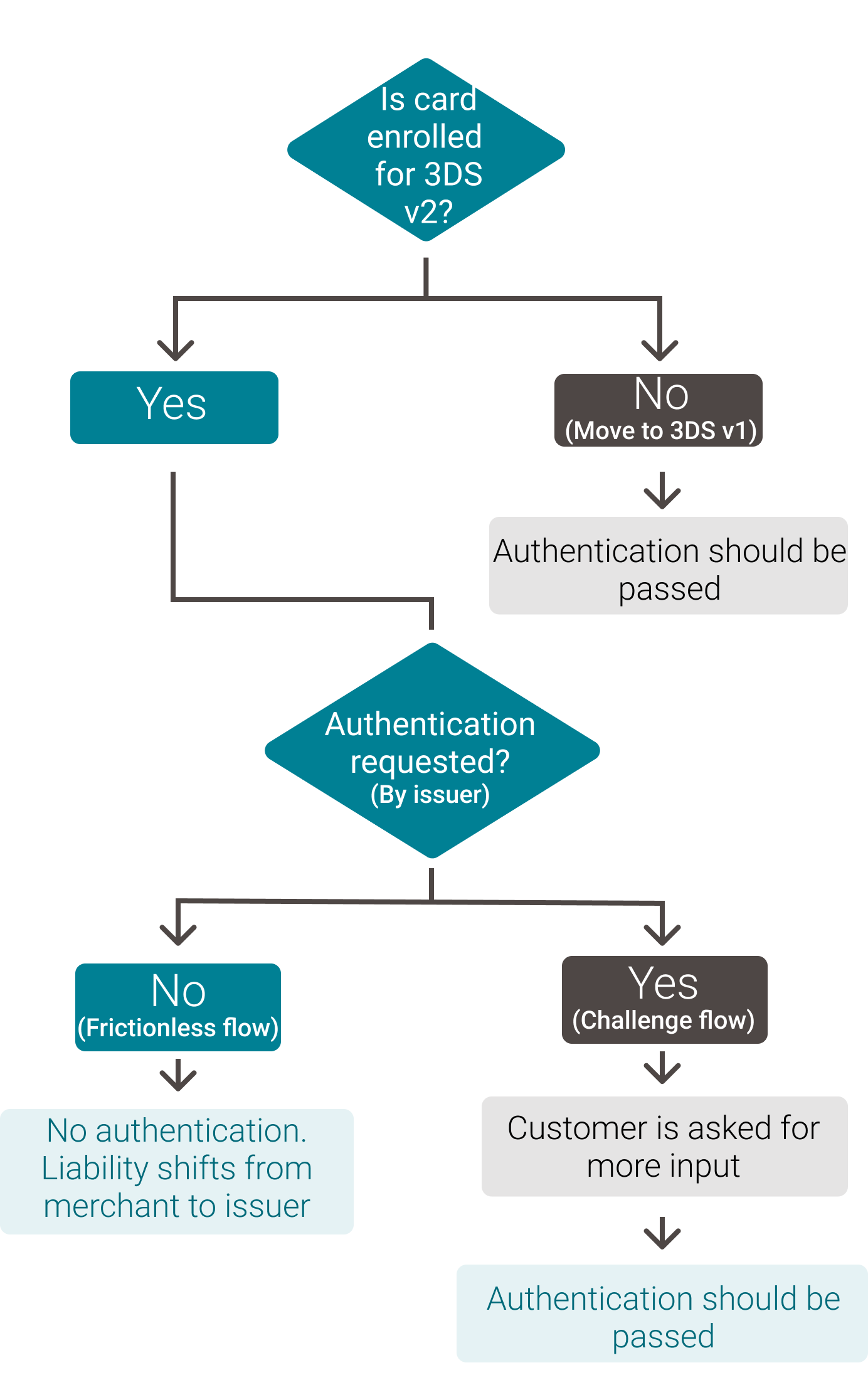

3DS v2 will send important data, such as the shipping address, the customer’s device ID and previous transaction history, over to the cardholder’s bank. The bank can then assess the risk level and if it trusts the transaction, the payment is made quickly and seamlessly (the customer will never even see 3D Secure v2 being applied). Alternatively, the bank can seek further input from the customer to authenticate the payment.

More sales, better experiences

Sharing more data and only conducting additional checks when necessary, means faster checkout times, extra security, improved sales and a better customer experience – and you can meet new SCA standards effortlessly.

If you are using our own payment page, moving onto v2 will be seamless for you, we will manage it on your behalf. If the payment page is embedded into your website, our customer support will be happy to advise you on your next steps.

For more information, go here for our eCommerce page or, here for your own page.