Transaction Statuses

1. Introduction

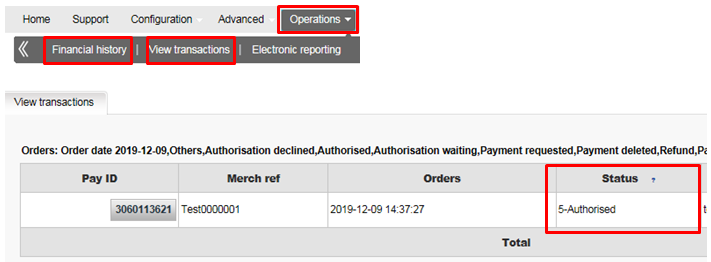

When you check your transactions in your Paypage account via Operations > View transactions or Operations > Financial history, and/or you download a monthly report of your transactions, you will notice that each transaction has a specific status.

2. Transaction statuses

Below we explain what status types there are and what they represent. The most common statuses are marked in bold.

| Status | NCERROR | NCSTATUS | Description |

|---|---|---|---|

| 0 - Invalid or incomplete | 500... | 5 | At least one of the payment data fields is invalid or missing. The NCERROR and NCERRORPLUS fields give an explanation of the error. |

| 1 - Cancelled by customer | The customer has cancelled the transaction by himself. | ||

| 2 - Authorisation refused | 300... | 3 | The authorisation has been refused by the financial institution. The customer can retry the authorisation process after selecting another card or another payment method. |

| 4 - Order stored | |||

| 40 - Stored waiting external result | |||

| 41 - Waiting for client payment | |||

| 46 - Waiting authentication | |||

| 5 - Authorised | 0 | 0 |

The authorisation has been accepted. An authorisation code is available in the “ACCEPTANCE” field. The status will be 5 if you have defined “Authorisation” as the default operation code in the "Global transaction parameters" tab, in the "Default operation code" section of the Technical information page in your account. |

| 50 - Authorized waiting external result | |||

| 51 - Authorisation waiting | 0 | 0 |

The authorisation will be processed offline. This is the standard response if you have selected offline processing in your account configuration. The status will be 51 in two events:

|

| 52 - Authorisation not known | 200... | 2 |

A technical problem arose during the authorisation/payment process, giving an unpredictable result. The merchant can contact the acquirer helpdesk to know the exact status of the payment or can wait until we have updated the status in our system. The customer should not retry the authorisation process since the authorisation/payment might already have been accepted. |

| 55 - Standby | |||

| 56 - Ok with scheduled payments | |||

| 57 - Not OK with scheduled payments | |||

| 59 - Authorization to be requested manually | |||

| 6 - Authorised and cancelled | |||

| 61 - Author. deletion waiting | 0 | 0 | The authorisation deletion will be processed offline. |

| 62 - Author. deletion uncertain | 200... | 2 | A technical problem arose during the authorisation deletion process, giving an unpredictable result. The merchant can contact the acquirer helpdesk to establish the precise status of the payment or wait until we have updated the status in our system. |

| 63 - Author. deletion refused | 300... | 3 | A technical problem arose. |

| 64 - Authorised and cancelled | |||

| 7 - Payment deleted | 0 | 0 | The payment has been cancelled/deleted |

| 71 - Payment deletion pending | 0 | 0 | Waiting for payment cancellation/deletion |

| 72 - Payment deletion uncertain | |||

| 73 - Payment deletion refused | |||

| 74 - Payment deleted | |||

| 8 - Refund | 0 | 0 | The payment has been refunded |

| 81 - Refund pending | 0 | 0 | Waiting for refund of the payment |

| 82 - Refund uncertain | |||

| 83 - Refund refused | |||

| 84 - Refund | |||

| 85 - Refund handled by merchant | |||

| 9 - Payment requested | 0 | 0 | The payment has been accepted. An authorisation code is available in the field “ACCEPTANCE”. The initial status of a transaction will be 9 if you have defined “Sale” as the default operation code in the "Global transaction parameters" tab, "Default operation code" section of the Technical information page in your account. |

| 91 - Payment processing | 0 | 0 | The data capture will be processed offline. |

| 92 - Payment uncertain | 200... | 2 |

A technical problem arose during the authorisation/payment process, giving an unpredictable result. The merchant can contact the acquirer helpdesk to know the exact status of the payment or can wait until we have updated the status in our system. The customer should not retry the authorisation process since the authorisation/payment might already have been accepted. |

| 93 - Payment refused | 300... | 3 | A technical problem arose |

| 94 - Refund declined by the acquirer | |||

| 95 - Payment handled by merchant | |||

| 96 - Refund reversed | |||

| 99 - Being processed |

Statuses with one digit are the most common statuses.

- 0: The transaction was not completed, because it was interrupted or because of a validation error. In case of a validation error, usually an additional error code (*) (NCERROR) identifies the error.

- 1: The transaction was cancelled by the customer/buyer

- 2: The acquirer did not authorise the payment

- 5: The acquirer authorised the payment. You should confirm these transactions to complete the payment, or delete the authorisation if you wish to cancel the order.

- 9: The payment was captured. Usually, with this status, you may expect the money on your account.

Statuses with two digits represent either ‘intermediary' situations or abnormal events. When the second digit is:

- 1, this means the payment processing is on hold. (e.g. status 91: payment waiting/pending)

- 2, this means an error occurred during the communication with the acquirer. The result is therefore not determined. You must contact the acquirer's help desk to find out the actual result of this transaction.

- 3, this means the payment processing (capture or cancellation) was refused by the acquirer while the payment had been authorised beforehand. It can be due to a technical error or to the expiration of the authorisation. You must contact the acquirer's help desk to find out the actual result of this transaction.

For a list of all possible statuses, please log on to your Paypage account and check the "List of the payment statuses and error codes" in the User guides section of the Support menu.

3. Transaction errors

The list of error messages is non-exhaustive and contains error messages that you may never encounter, often because they don't apply for your account type or because they're payment method specific.

In general, error codes starting with:

- 2 mean the status is "uncertain". This will usually evolve to a final status.

- 3 mean the transaction is declined by the acquirer or blocked by the Fraud detection module

- 4 mean the transaction is declined. It could be only a temporary technical problem. Please retry a little bit later.

- 5 mean a validation/configuration error (e.g. currency not allowed on your account).

For a list of all possible error codes and messages, please log on to your Paypage account and check the "List of the payment statuses and error codes" in the "Selected user guides" section of the Support menu.

FAQs

In your Paypage account menu, you can easily lookup your transactions by choosing "Operations" and then clicking either "View transactions" or "Financial history", depending on the type of transaction results you're looking for.

By default you can send goods or deliver your service once a transaction has reached the status "9 - Payment requested". However, although status 5 is a successful status, it's only a temporary reservation of an amount of money on the customer's card. A transaction in status 5 still needs to be confirmed (manually or automatically) to proceed to the status 9, which is the final successful status for most payment methods.

You can easily refund a payment with the "Refund" button in the order overview of a transaction (via View transactions). If your account supports it, you can also make refunds with a DirectLink request or with a Batch file upload (for multiple transactions).

Please note that the Refunds option has to be enabled in your account.

Contact your sales contact or epay@kbc.be for this.

A full green thumbs-up icon means that the transaction was completed with a 3-D Secure authentication method, such as Digipass or a card reader. However, it doesn't necessarily mean the payment itself was processed successfully. Therefore, you should always check the transaction status to know whether you'll receive your money.

If you want to check specific details of an order/transaction or perform maintenance on transactions, you should use View transactions. "Financial history" is the most convenient to periodically check incoming and outgoing funds.

For more information, go to View transactions vs Financial history.

You can only perform refunds on transactions which have already received status 9 for at least 24 hours. A cancellation or deletion can be done within approximately 24 hours after final status has been received (status 9 or 5).

To know the cut-off time of the acquirer, we recommend you to check directly with our Customer Care department.

There are different reasons why you can't refund a transaction. You need to consider the following (with the condition that the Refund option is enabled in your account):

- The transaction is in an "incomplete" status, such as a pending or erroneous status (91, 92 etc.) that doesn't allow the refund operation.

- If the transaction is authorised (status 5), at which point no payment has been made yet. In this case you have to cancel the authorisation instead of refund.

- The used payment method doesn't support the refund functionality, which can be the case with certain debit cards, web banking methods and "offline" payment methods such as Bank transfer.

Once a transaction reaches status 9, meaning that the customer has paid, the acquirer or bank will deposit the money to your account. The time when this payout occurs differs per payment method and acquirer. We recommend you to check directly with the acquirer or bank, if you believe you're not receiving your money in a timely manner.